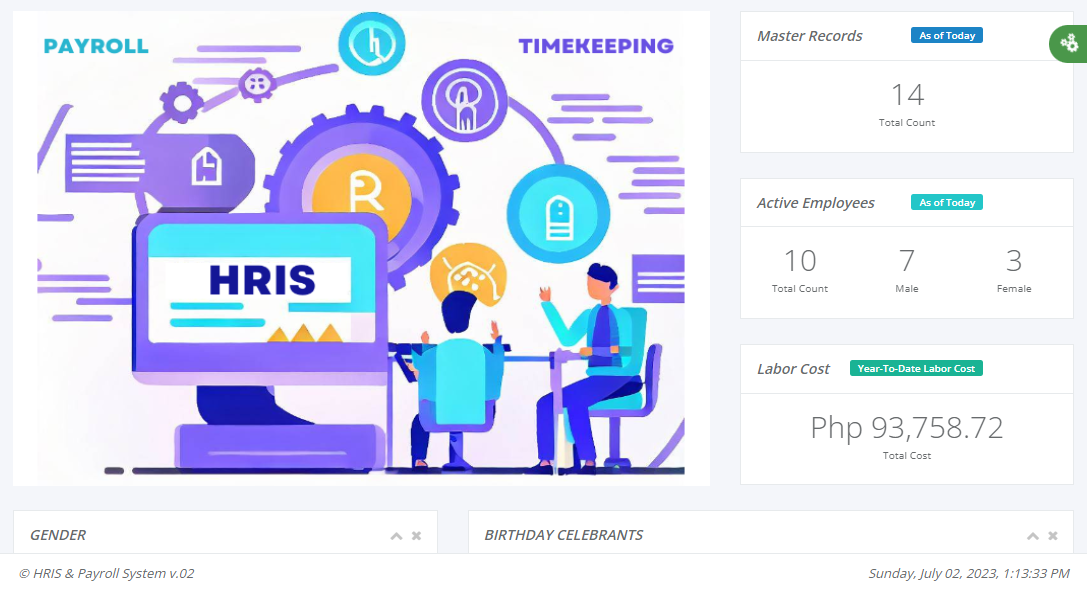

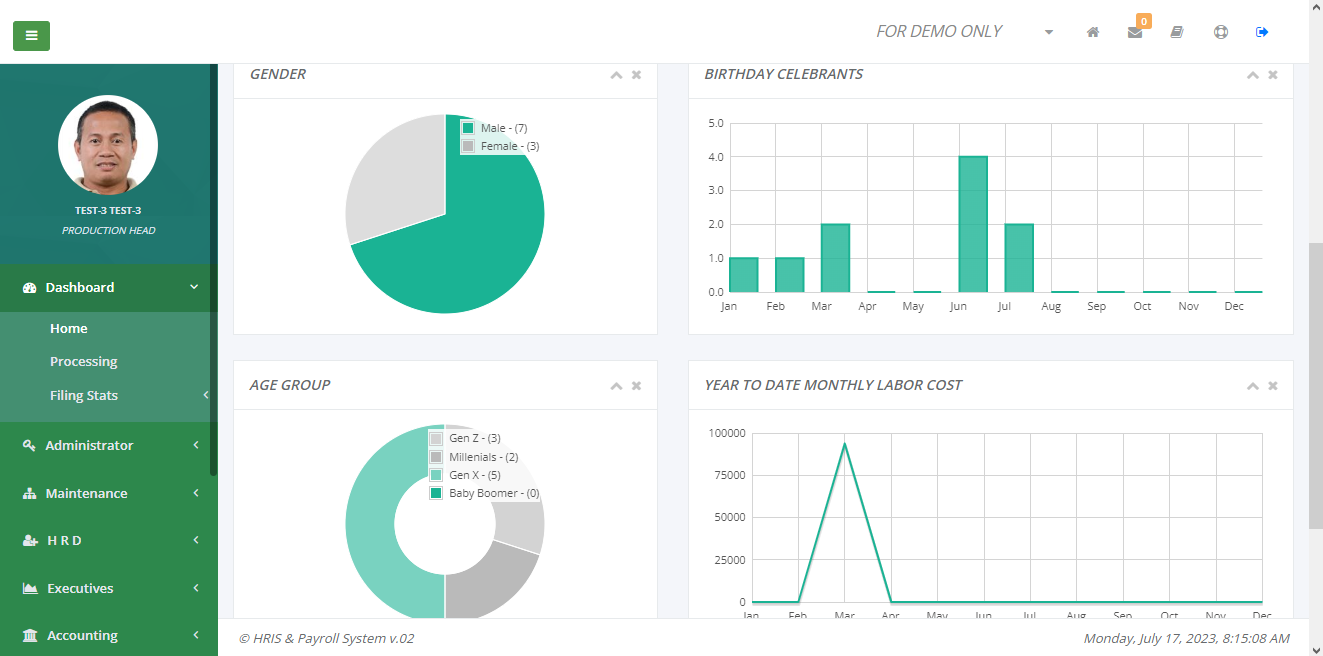

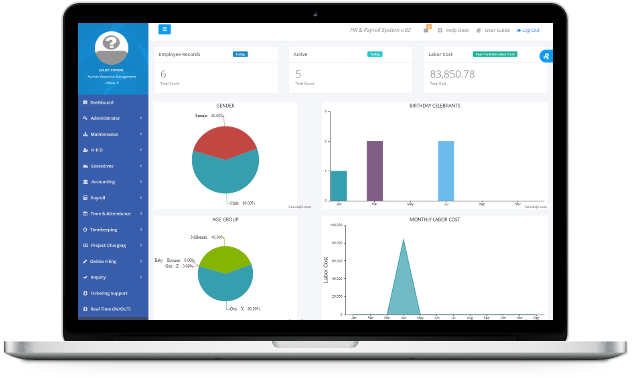

HRIS &

Payroll System:

Paperless Process

Automation

Integrated HR and payroll software in the Philippines

for small business or big companies with multiple branches.

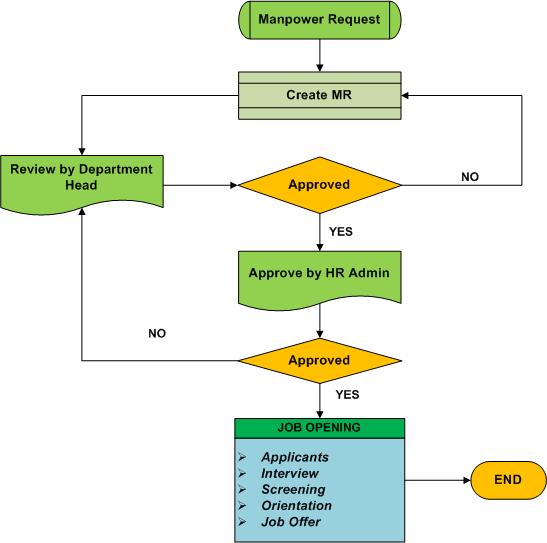

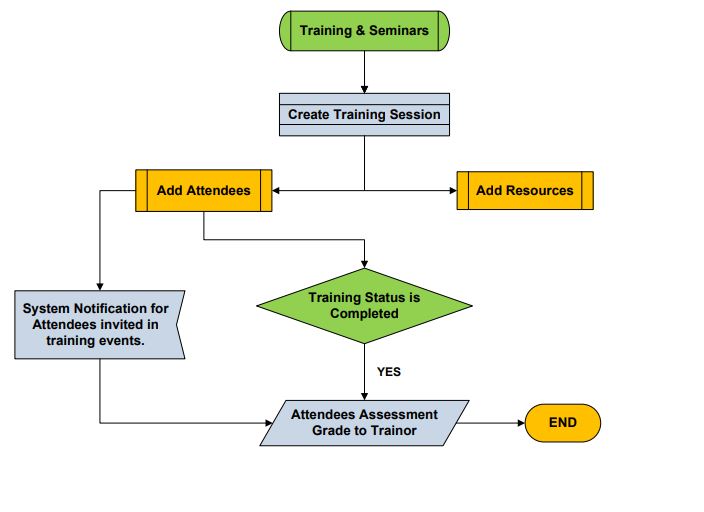

Manpower Request,

Recruitment & Training

HR tools designed to automate manpower request,

recruiting, training and staffing operations.

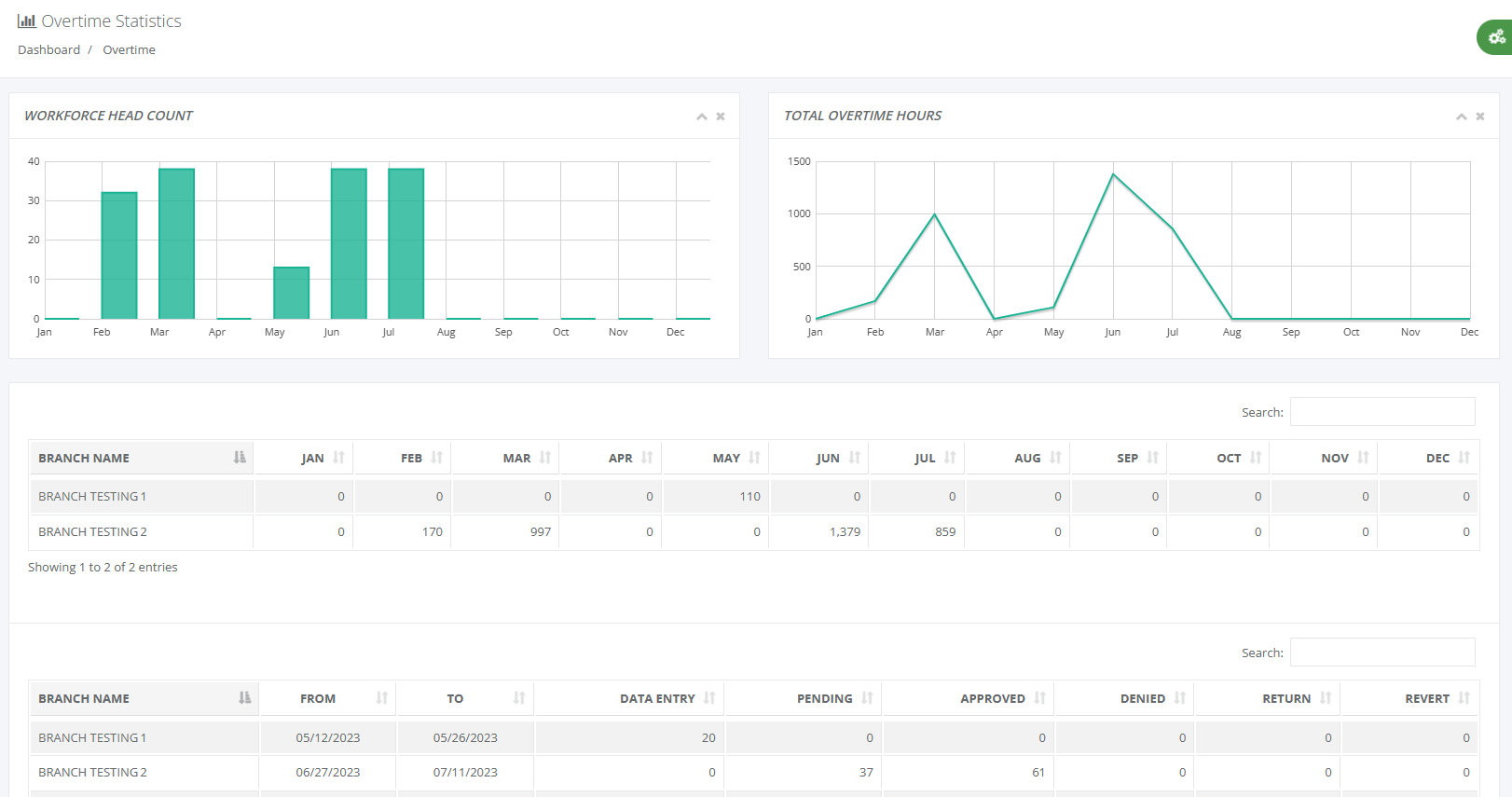

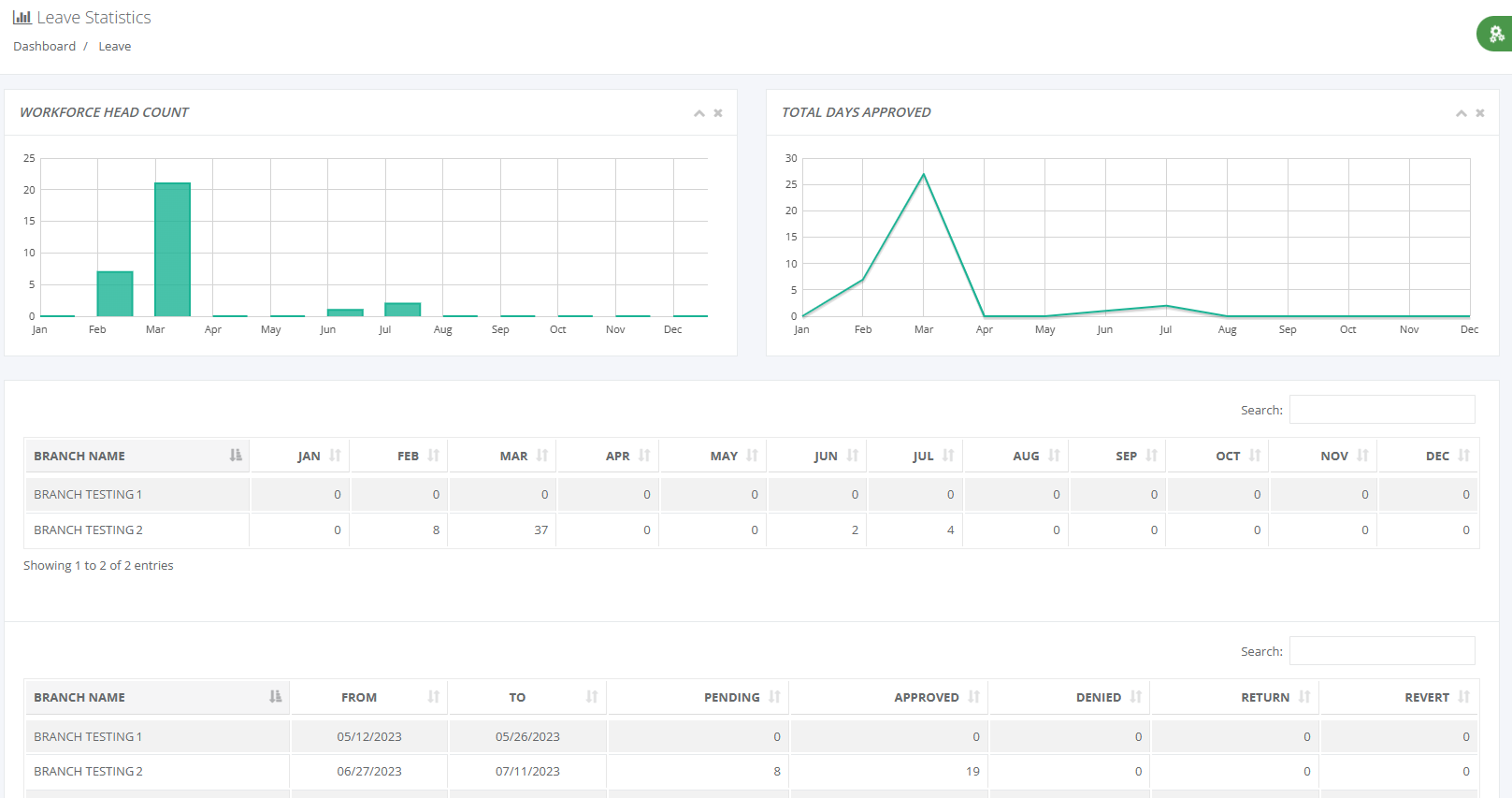

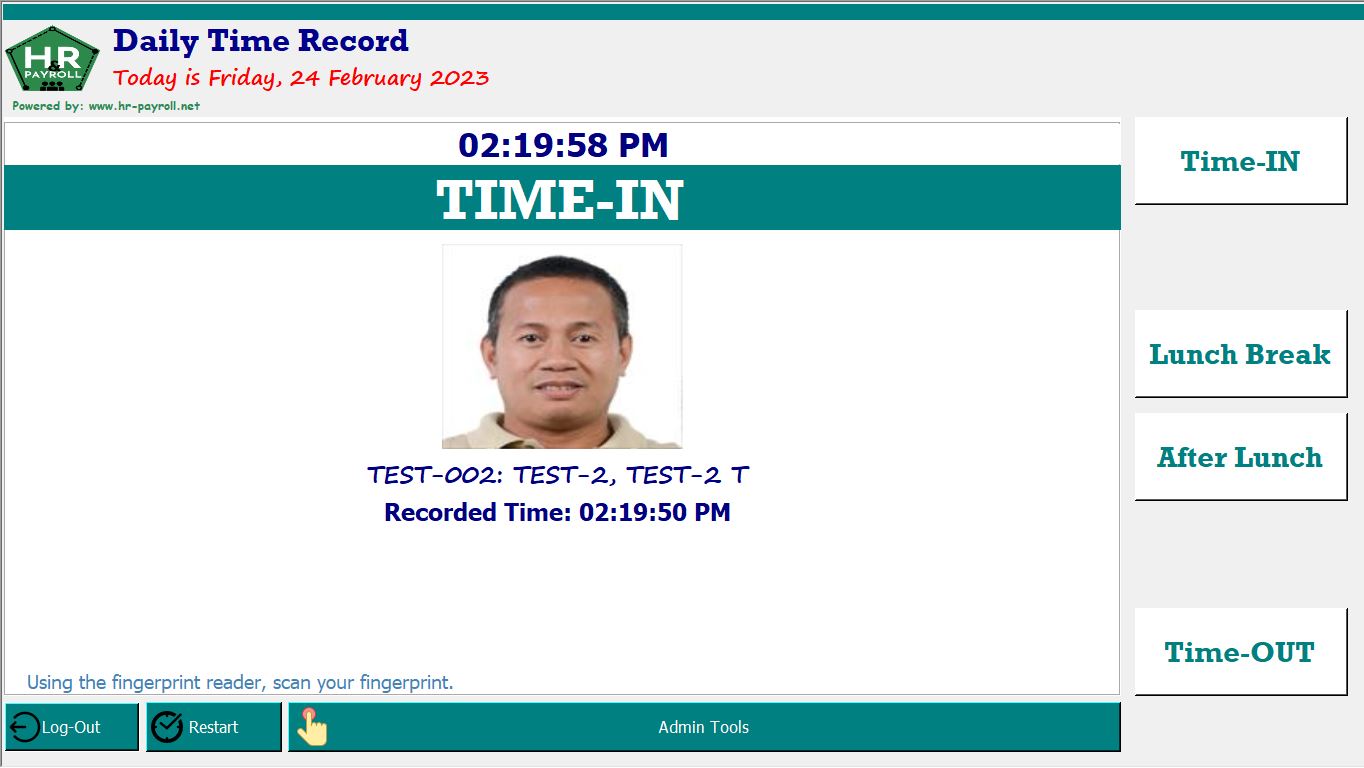

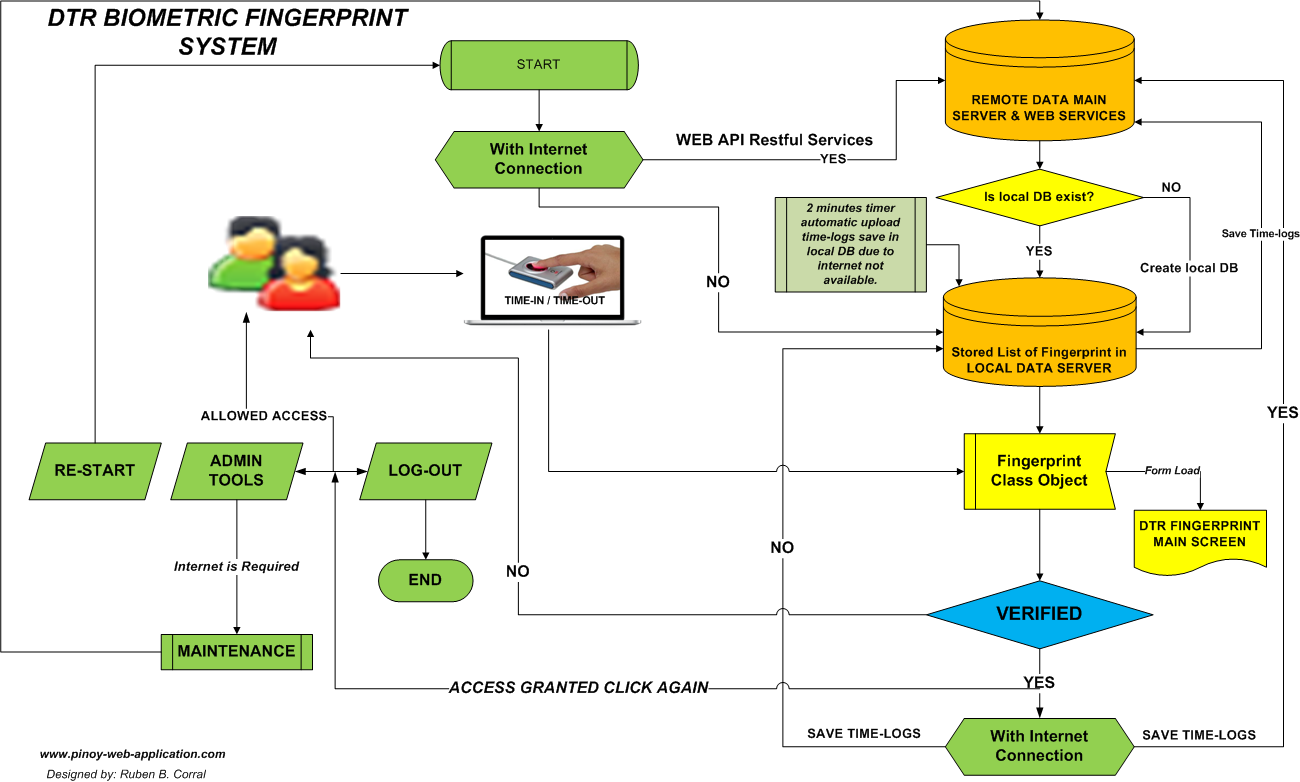

Biometric Finger Scanner

Time-In / Time-Out

Daily Time Record (DTR),

Manpower Count Report,

Real Time Monitoring.

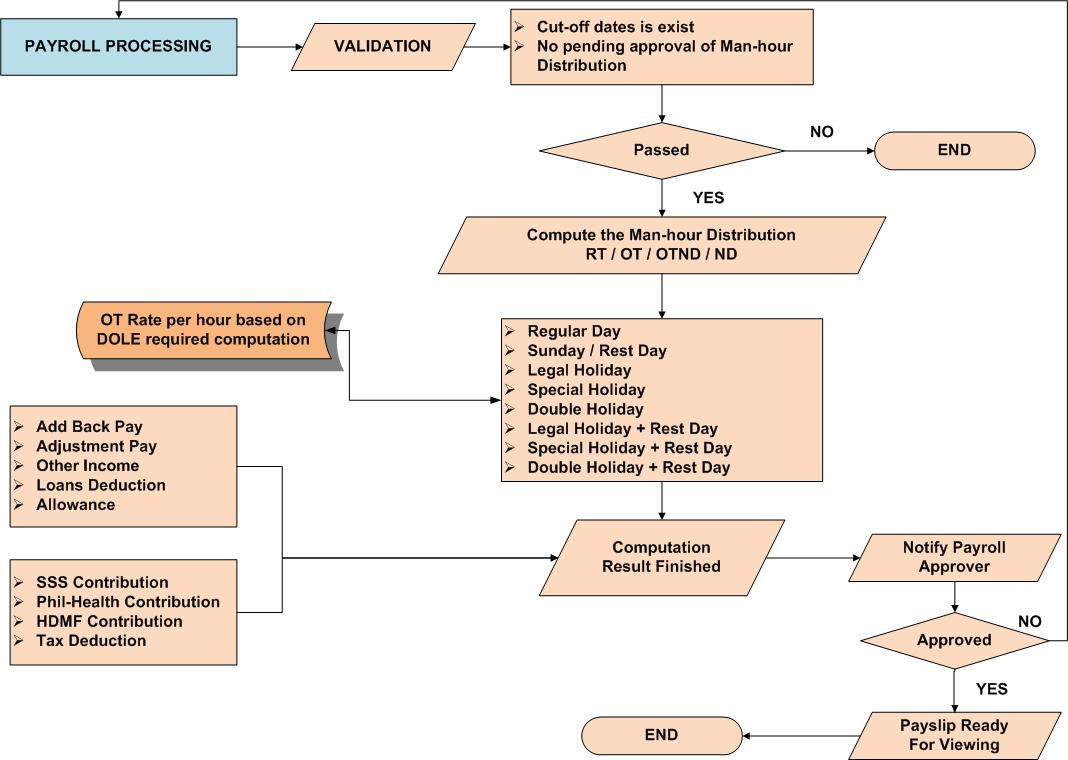

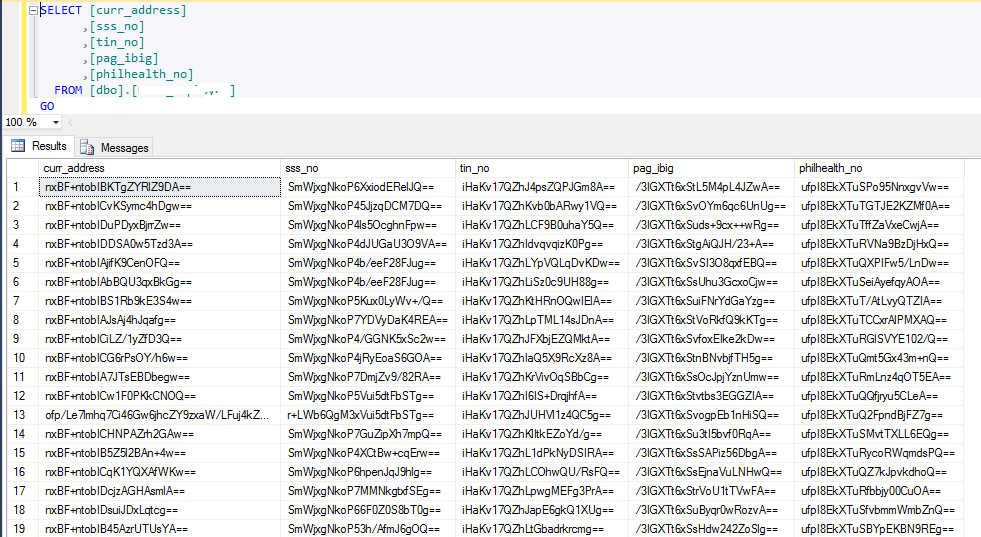

Timekeeping & Payroll

Process

Perform tasks to ensure accurate

work hours salary computation,

deduction of tax, loans & mandatory

contribution of SSS, Philhealth,

Pagibig and other deductions.